Millions of American homes are threatened by flooding, but it can be extremely difficult for a home buyer to gauge the risk due to a lack of access to a property’s flood history. Nearly half of all states do not require sellers to tell buyers whether a property has been flooded—that needs to change.

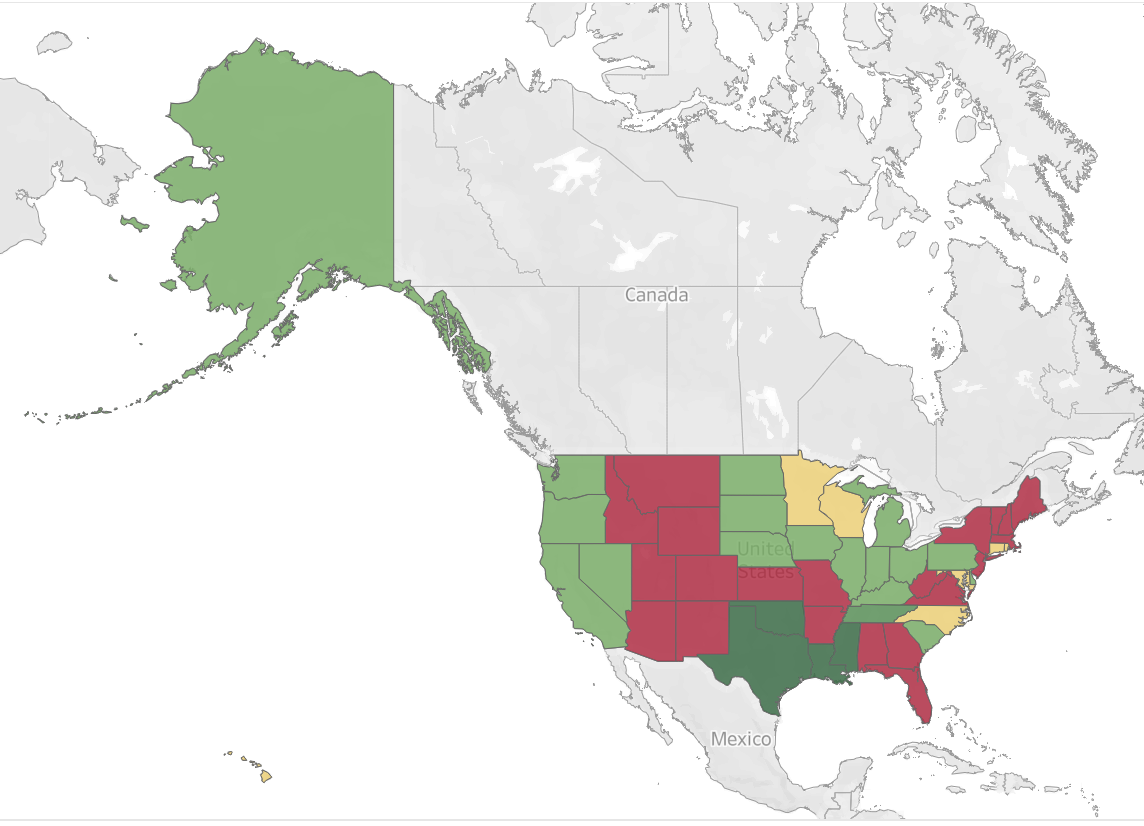

NRDC and Columbia University’s Sabin Center for Climate Change Law reviewed all 50 states’ real estate disclosure laws and found that in many places, home buyers are not given the information that they need to make informed decisions about whether they should buy a house, which is a major financial investment.

Explore the interactive map detailing each state’s provisions, including:

We cannot expect home buyers to make good decisions if they are denied information. States should have disclosure laws that ensure that persons selling a property disclose the following information:

However, such disclosure and transparency provisions should not be limited to disclosure requirements imposed on sellers. The National Flood Insurance Program (NFIP) must also improve the information that is available to both home buyers and homeowners. Current homeowners that have not had the luxury of living in a state with good flood hazard disclosure laws should have a right to know about their property’s flood risk. This should include any past history of flood insurance coverage, damage claims paid, and whether there is a legal requirement to purchase flood insurance because of past owners’ receipt of federal disaster aid. This is information that Federal Emergency Management Agency should have if a property was ever covered by the NFIP.

As part of NFIP reform, the program should evolve to require greater disclosure and transparency of flood risk data. Such reforms should include:

As sea levels rise and heavy rainstorms become more common, tens of thousands of communities can expect increasing vulnerability to flooding. Homeowners, buyers, and renters should not be kept in the dark about this risk when choosing where their family will call home.